Agriculture industry leading to a spate of new business models consolidation and thus MA activity. The most active acquirers with multiple transactions in the period include Pinnacle Agriculture The Climate Corporation Scotts Miracle-Gro Intrexon Nutrien Bayer DTN DuPont John Deere and.

9 Mental Map Causal Loop Diagram Of Smallholder Agriculture In Download Scientific Diagram

Mergers and acquisitions MA deal activity in the Food and Beverage industry remains active with 271 deals closed over the last 12 month LTM period ending Oct.

Agriculture m&a transactions. For investors this presents tremendous opportunity. Clear Filters -Closed Transaction w Undisclosed Values. With our integrated global platform and unique one team approach we are ideally positioned to advise on transactions involving buyers and targets across the world.

In 2018 the number of deals has decreased by 8 to about 49000 transactions while their value has increased by 4 to 38 trillion USD. Verdant Partners is wholly focused on food and agribusiness. The Big Six in the agricultural seed chemical and traits area BASF Monsanto Bayer Dow Syngenta and DuPont are rapidly becoming the big fourBASF Bayer-Monsanto DowDuPont and ChemChina-Syngenta.

Value of MA Worldwide. As of June 2021 the largest ever acquisition was the 1999 takeover of Mannesmann by Vodafone Airtouch plc at 183 billion 284 billion adjusted for inflation. 14032019 During 2018 over 60 of crop agriculture MA transactions involved companies that are categorized in these four broad segments.

49 611 20 58 55 0 infocometisde Directions Shop Facebook. To view the first article click here. We have built a team of professionals with real world industry experience having developed skills that extend beyond those of traditional MA.

The market witnessed several major transactions through Q4 2019 and. Created with Highcharts 620. MA trends valuations and investments.

Within the United States Agribusiness grosses some 30 trillion in revenue per anum but the industry has been steadily declining at -19 since 2012. These conditions are guaranteed by FAS AG as our experienced consultants have the necessary holistic expertise. Shareholders are expected to vote on the proposed transaction by early November with an expected close date of mid-2017 pending regulatory approvals.

Cometis secures your MA transactions with a strategic communication plan ensuring the success of your Mergers. The value chain can be long and complex markets can be volatile competition intense margins thin and performance can hinge on a. MA Accounting FAS AG Services You will receive a systematic structured and sustainable handling of a transaction with sufficient availability of capacities.

Food and Beverage MA Landscape Spring 2020 MA Market Overview MA deal activity in the US. 06072021 Global fertilizers and agricultural chemicals transaction volume 2010-2020. In 2020 there was a total of 51 mergers and acquisitions in the.

Agrium and Potash Corp announced recently their plans to merge to form the largest crop-nutrient company in the world with an enterprise value of approximately 36 billion. 17062019 We at Ocean Park believe that MA activity will accelerate as these new mega companies complete their reorganizations and go back on the hunt for accretive acquisitions. Although MA activity has not slowed down the market has not seen any multibillion dollar transactions closing since our Summer 2018 report.

Acquisitions With years of experience advising entrepreneurs private equity funds and international corporates on mid-cap MA transactions we provide more than just an international and interdisciplinary team. Published by Luca Fernndez Jul 6 2021. And Canadian food and beverage industry saw a slight downtick in the trailing twelve months TTM ending March 31 2020 with 280 deals closing over the period.

Acquisitions also took place in the machinery arena with AGCOs purchase. This trend is expected to continue in 2019 especially in vegetables and fresh produce where consumer preference and improving median incomes will drive fresh market purchasing decisions. Agtech VC.

As MA projects become more international in scope global reach and local knowledge have become indispensable elements of the MA service offering. All our transactions at a glance Mergers. The following tables list the largest mergers and acquisitions by decade of transaction.

But investing in agriculture is not easy. 20122017 Mergers and acquisitions picked up in the agricultural arena in 2017. This is the second piece of a multi-part series covering the Agriculture technology AgTech industry.

21 rows Agricultural Sector - Transaction Multiples Epsilon Research covers the MA. We advise buyers and sellers through the business transactions that shape the competitive landscape of our industry. Since 2000 more than 790000 transactions have been announced worldwide with a known value of over 57 trillion USD.

Deals posted may still be subject to various regulatory approvals and customary closing conditions. Transaction values are given in the US dollar value for the year of the merger adjusted for inflation.

Digital Agriculture Enough To Feed A Rapidly Growing World Ey Luxembourg

Agribusiness Industry Consulting And Strategy Bcg

-1.png?width=600&name=KTS-Agriculture%20(1)-1.png)

M A Keys To Selling Your Agriculture Business

Https Assets Kpmg Com Content Dam Kpmg Sg Pdf 2017 01 Eight Key Trends Driving Ma In Agribusiness Pdf

Digital Agriculture Enough To Feed A Rapidly Growing World Ey Luxembourg

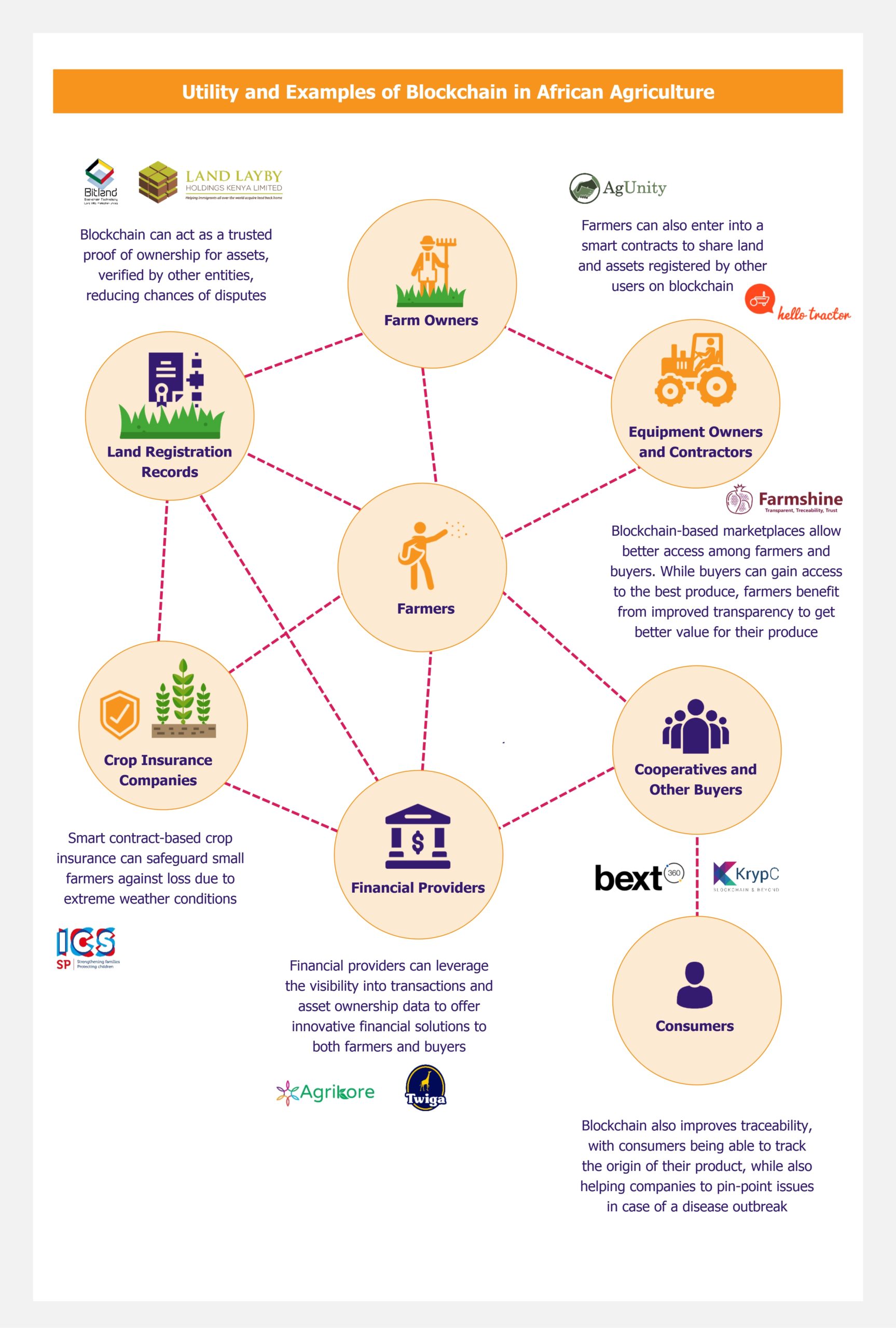

Agritech In Africa How Blockchain Can Help Revolutionize Agriculture

Agriculture 4 0 Agriculture 4 0 The Savior For The Global Agriculture Auto News Et Auto

Https Www Cdiglobal Com Storage Files Resources Cdi Food And Agriculture Brochure 2019 Pdf

Agri Frontier Limited Is An Agri Investment And Agribusiness Advisory Firm Online Presentation

0 comments:

Post a Comment